national security interests.Īs we talked about earlier this year, it's a story of survival for many of the young publicly traded names. Morgan Stanley emphasized that the recent deals "reflect the attractiveness of the space endmarket," especially given the sector's continued growing importance to U.S. Morgan Stanley in a note to clients recently highlighted those deals as evidence that "space companies on Santa's List," and I suspect M&A won't be slowing down in 2023. Even shares of Rocket Lab and Planet – two of Wall Street's favorite space de-SPACs, with some of the strongest revenue and cash positions – have given up half their go-public value.īut there were a handful of winners: Year to date, Iridium ended up the strongest, climbing about 23% – while both Maxar and Aerojet Rocketdyne surged into the green thanks to tentative acquisition deals from Advent and 元Harris, respectively. Astra, Momentus and Spire each slipped under $1 in the past few months.

Now, seven such companies trade under $2 a share. Remember, these space SPAC names all came to market at about $10 a share. Personal Loans for 670 Credit Score or Lower Personal Loans for 580 Credit Score or Lower Velo3D was seemingly caught up in the same “war bump” tailwinds that benefitted legacy aerospace & defense companies in February-this actually makes sense for $VLD, as A&D companies account for nearly 50% of the company’s total addressable market so $VLD would benefit from greater government defense contracting.Best Debt Consolidation Loans for Bad Credit Finally it finished the month strong with the market’s rally during that time period. Then $RDW sold off with the rest of the market though the middle of February.

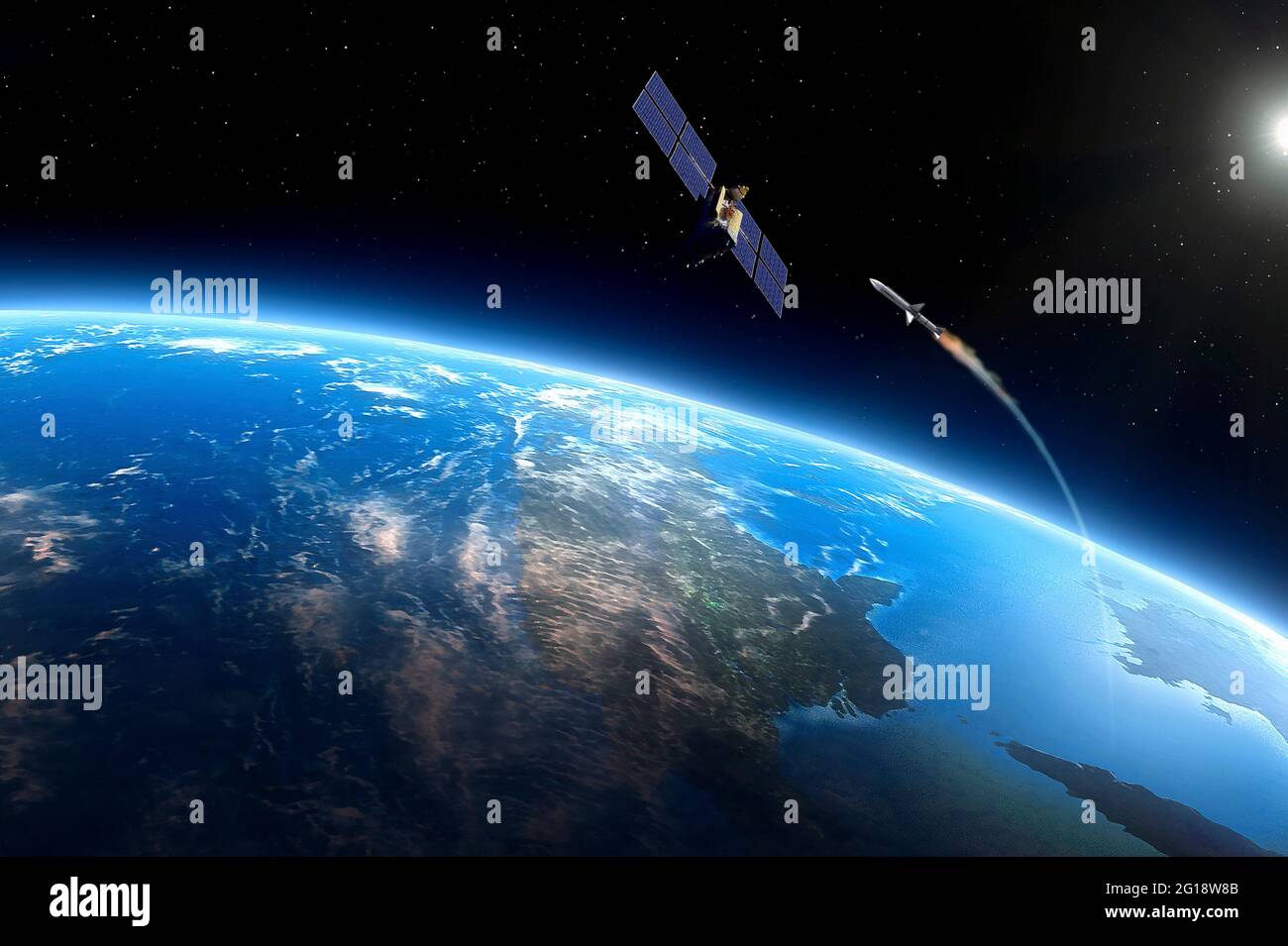

#Best space warfare stocks update

Redwire had a volatile month-it started February strong by FINALLY providing an update on its pending internal accounting investigation (no skeletons found in the closet thus far) and announcing preliminary 4Q results. These announcements matter for $MNTS because the company has yet to formally test its Vigoride transporter in space, and won’t do so until June 2022. In early February Momentus’ launch partner, SpaceX, announced a new multi-launch contract with in-space transporter Launcher Space, expanding upon a prior launch services agreement. Momentus’ underperformance was likely due to a few recent announcements by in-space transportation competitors:Īt the end of January, established in-space transporter D-Orbit announced plans to go public via SPAC. Unfortunately because Spire doesn’t capture optical imagery, it hasn’t received the same kind of public attention that the other EO companies have gotten since the end of February.ĪST SpaceMobile’s strong performance was potentially driven by the 2/15 release of a video featuring the CTO of a key $ASTS partner, Vodafone, speaking to why $VOD decided to partner with $ASTS (see below).

Spire was up +30% early in February after pre-reporting preliminary 4Q21 results, but these gains disappeared by the end of the month. I believe the circulation of these companies’ Ukraine imagery in the press is a great opportunity to show how people on Earth can benefit from technology in space.Īdditionally, heightened usage by government entities during this time suggests that these EO companies may report strong 1Q22 revenue. Virgin Galactic’s positive momentum was driven by 1) a mid-February announcement that ticket sales were opening to the public and 2) relatively positive 4Q21 earnings later in the month.Įarth observation stocks ( Planet Labs, Satellogic, BlackSky ) were set for a tough month prior to the start of the Russia-Ukraine conflict, but they partly recovered due to the market rally from 2/23-2/28.

Rocket Lab had a lot of notable positive news in February-early February $RKLB momentum was due to the company’s announced plans to expand its Colorado footprint and the opening of a 3rd launch pad, while a $143M contract win on 2/24 propelled shares at the end of the month. While Rocket Lab did finish the month up +6%, it was on pace for a double-digit return before shares traded in sympathy with Astra following the latter’s failed launch. Astra was actually on track for positive returns before a failed launch attempt on 2/10, after which shares plummeted -26% in a single day and remained depressed ever since.

0 kommentar(er)

0 kommentar(er)